- Manganese alloys production rises on capacity expansion

- Smelters restock ahead of elections, reap price benefits

- Higher crude steel output fuels Mn alloy demand

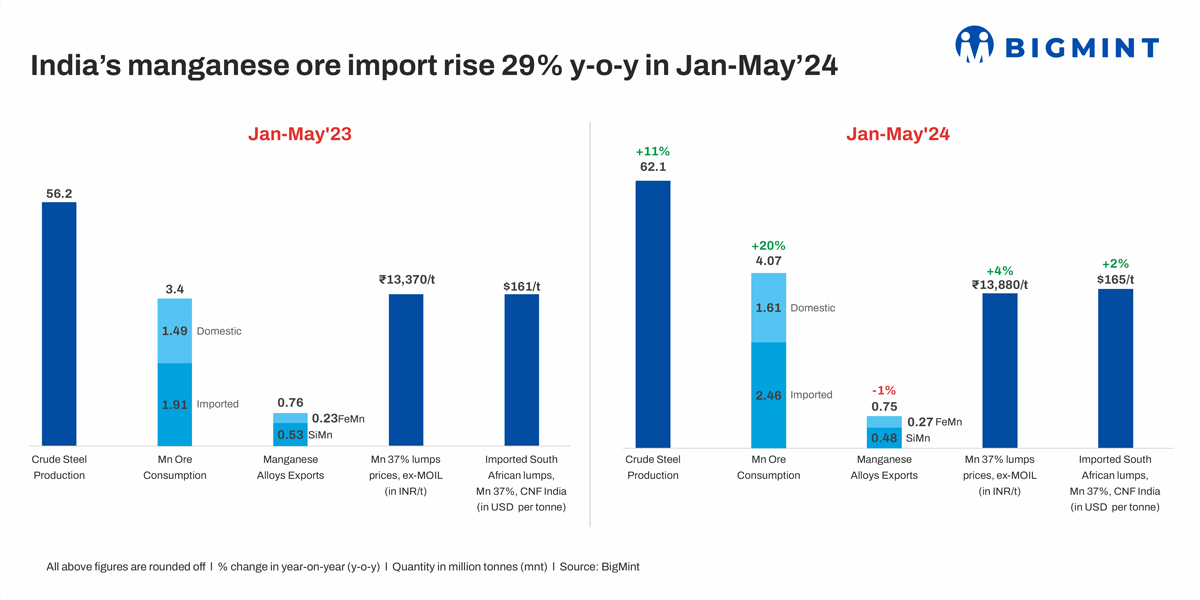

Morning Brief: India’s imported manganese ore volumes rose a sharp 29% y-o-y to 2.46 million tonnes (mnt) over January-May 2024 (5MCY’24) against 1.91 mnt in the same period last year.

Country-wise imports

South Africa remained the largest exporter over January-May 2024, with 1.42 mnt, showing an increase of 18% y-o-y. Gabon followed with 0.85 mnt, up 60% y-o-y, while Cote D Ivoire was in third place with 0.15 mnt, recording a humongous growth of 150% y-o-y but on a low base.

Grade-wise imports: A mixed trend

The grade-wise break-up throws up a mixed trend. This was mainly because smelters went slow in importing grades for which there was adequate domestic availability, which eased the reliance on imports but underscored the point that demand overall had increased. In fact, domestic manganese ore production rose 8% to 1.61 mnt over 5MCY’24 y-o-y (1.49 mnt) to feed the growing off-take.

Reasons behind manganese ore import riseIncreased manganese alloys production – There has been a sharp increase in manganese alloys production in the two production hubs for the same in India – Vizag and Raipur – on the back of new capacities going onstream. This, in turn, fuelled the demand for both imported and domestic manganese ores.

During the first five months of 2024 smelters in the Vizag area increased total capacity by 60-70 megavolt-ampere (mva). The expansion spanned furnaces of varying capacities, ranging from 9-33 mva. These cumulatively have a capacity to produce an additional 10,000-15,000t per month. Key Raipur smelters too have set up fresh 40-50 mva capacities. This expansion has necessitated increased volumes of imported ore to meet production requirements.

Rising crude steel output fuels demand: India has so far been the sweetest spot on the global steel terrain. Through the first five months of calendar 2024, crude steel production rose 11% y-o-y to around 62 mnt. This growth was primarily driven by a 2% y-o-y increase in production via the blast furnace-basic oxygen furnace (BF-BOF) route, a key consumer of manganese alloys.

Restocking demand from smelters: Smelters had restocked well in advance, based on a few reasons. First, they had anticipated a sharp increase in crude steel production ahead of India’s general elections. Manganese ore takes at least two-and-half months to arrive at Indian ports from the point of booking done at a South African port. The material that arrived in March had actually been booked in January. Secondly, at the time of booking, ending of the last year, manganese ore prices had been at historically low levels and this prompted buyers to book larger volumes to reap the price benefit. Thirdly, in March, South32 had announced the closure of operations at its GEMCO mines. This event likely caused concerns about potential price increases, leading producers to book significant volumes in advance.

Import parity drives port-based purchases: Favourable import parity conditions incentivised port-based ore buyers too. Landed prices of Mn37% ore from South Africa were at $142-147/t CNF. In rupee parity, this compared more or less favourably with the ex-works (exw) prices of domestic miner MOIL’s INR 12,221-12,832/t ($147-$154/t) in January- February 2024, for the same grade.

Buyers opted for bulk purchases, taking advantage of the lower imported prices since domestic prices over these five months were actually higher.

Outlook

India’s manganese ore imports may become sluggish in the third quarter (Q3CY’24) amidst slowdown in steel demand and resistance from smelters to procure at the higher end of the price spectrum.

Domestic manganese alloys consumption also raises concerns, with a key Durgapur importer predicting stable prices until a global surge in bulk manganese alloy demand materialises. This aligns with reports of lower bulk bookings in recent months after a surge in imported ore by Indian smelters.

BigMint is ‘knowledge and marketing partner’ at IFAC 2024

BigMint is teaming up with The Indian Ferro Alloy Producers’ Association (IFAPA) as the Knowledge and Marketing Partner for the 4th International Ferro Alloys Conference, 2024 (IFAC 2024). The conference is a pivotal annual gathering of professionals, experts and stakeholders. This year will be no less an august event, with a central focus on green energy and decarbonisation as a commitment for advancing towards a more sustainable future for the ferro alloys industry worldwide. IFAC 2024 will focus on production, market trends, technological advancements, challenges and enablers. Register fast to catch the early-bird offers. Let us meet over 17th-19th September, at the Taj Palace, New Delhi.