- Bids for some grades drop in OMC’s auction

- Tsingshan’s June’24 tender prices stable m-o-m

- European benchmark prices to be discontinued from June

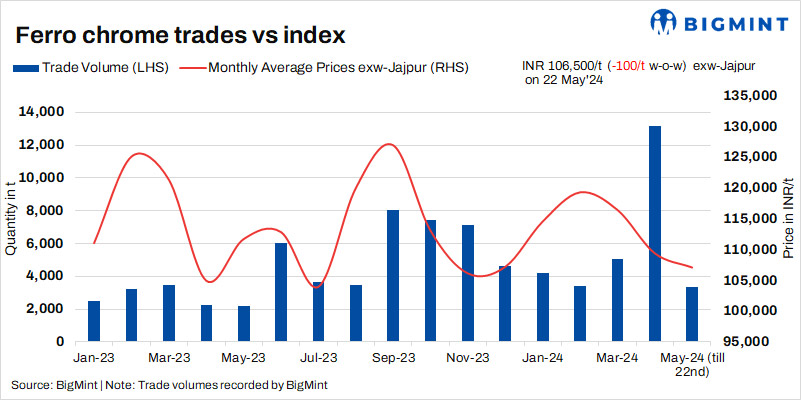

Indian high-carbon ferro chrome (HC60%, Si:4%) prices remained steady w-o-w, decreasing slightly by INR 100/t ($1/t) w-o-w compared with the previous assessment on 15 May 2024. Prices stayed stable because the market did not show any significant improvement in demand.

As per BigMint’s assessment on 22 May, high-carbon ferro chrome (HC60%, Si:4%) prices were INR 106,500/t ($1,279/t) exw-Jajpur. Last week, around 600 t of trades were finalised in the price range of INR 104,000-108,000/t ($1,249-1,297/t).

With a slight increase of INR 100/t ($1/t) w-o-w to INR 114,300/t ($1,373/t) exw-Jajpur, prices of high-carbon low-silicon ferro chrome (HC60%, Si:2%) also stayed stable. Low-carbon (C:0.1%) ferro chrome prices, however, decreased by INR 2,000/t ($24/t) w-o-w to INR 235,000/t ($2,822/t) exw-Durgapur on 23 May.

Auctions in domestic market: On 21 May, OMC’s chrome ore auction was concluded, with all 67,300 t of material sold out. For high-grade ore (52 to +54%), premiums increased by 24-55% (INR 4,900-11,700; $59-141) over the base price. However, the bids for the remaining grades decreased by around INR 2,600 ($31).

Two more ferro chrome auctions are scheduled for 24 May, one by OMC and the other by Vedanta-FACOR. Market participants are keeping an eye on the outcomes of these auctions.

Taking into account the generally low level of domestic demand, a key producer told BigMint: “We have currently stopped offering in the domestic market and only catering to export orders as realisation is a bit better in exports.”

Global market conditions: Ferro chrome (HC60%) prices in China inched up by RMB 100/t ($14/t) w-o-w to RMB 9,150/t ($1,263/t) exw-Inner Mongolia. According to reports, rising raw material costs contributed to the price rise.

Tsingshan has announced its ferro chrome tender prices for June at RMB 8,995/t ($1,242/t), unchanged m-o-m. It could be due to firm domestic prices over the past few weeks.

Furthermore, a significant South African producer of ferro chrome, Merafe, has declared that it would stop releasing quarterly European benchmark prices from 2024.

Uptrend in stainless steel sector: Prices for 304 grade stainless steel went up by INR 5,000/t ($60/t) w-o-w, reaching INR 182,000/t ($2,186/t) exw-Mumbai. This resulted from a $1,540/t w-o-w increase in LME nickel prices. Some producers also increased their prices. However, given the recent fluctuations in LME nickel prices, the market is still uncertain.

Outlook

The moderate response to OMC’s chrome ore auction may exert additional pressure on prices. However, given the current cost dynamics, a significant fall seems less likely. Further clarity may emerge after the upcoming auctions.